Holiday Tech and Money Safety After 60

A calm December checklist for tech and money safety after 60 with a simple 15-minute weekly routine, safe gifting tips, and a gentle digital legacy nudge.

A Calm Checklist for December

December is full of joy, traditions, and surprise expenses. It is also the month when scammers and sneaky online traps ramp up because they know people are busy, distracted, and shopping fast.

This is why I love a simple routine you can repeat every week. Nothing scary. Nothing complicated. Just small steps that protect your peace and your wallet.

If you already read my Year End Digital Checkup After 60 and my post on AI, media, and misleading quick wins, think of this as the December specific companion. Same calm energy, more holiday focused, and easy to follow when life is full.

Why December is peak scam season

The holiday season brings a perfect storm for digital risk.

- More online shopping

- More delivery notifications

- More gift cards

- More last minute choices

- More emails and texts that look real at first glance

Scammers count on speed. Your greatest protection is a simple pause and a few smart habits.

The 15 minute weekly safety routine

Set a gentle reminder once a week. Pick any day that fits your schedule. Friday works well if you want to reset before the weekend.

1. The two minute banking glance

You are not doing a full accounting session. You are simply scanning for anything that looks unfamiliar.

Check:

- Recent transactions

- Small test charges

- New subscriptions

- Payment apps for surprise transfers

If something looks off, contact your bank using the official number on your card or the bank website. Not the number in a text or email.

2. A three minute email cleanup

This is not about achieving inbox perfection. It is about reducing risk.

Do this:

- Search for the words: order, delivery, invoice, password, verify

- Delete anything you do not recognize

- Unsubscribe from stores you no longer use

Less noise means fewer chances to click the wrong thing.

3. The text message rule

This one saves people constantly.

Do not click links in unexpected texts.

Even if it looks like:

- USPS

- Amazon

- A bank

- A retailer

- A refund notice

Instead, open the official app or type the website yourself.

4. A five minute password micro update

You do not need a total overhaul right now. Just a small upgrade.

Pick one category each week:

- Banking

- Shopping

- Password manager

Quick rule of thumb:

If a password is old, reused, or simple, it is time.

If you use a password manager, even better. This is a great month to lean on it.

Safe gifting habits that protect your budget

Subscription audits

December is a sneaky month for forgotten charges.

Check for:

- Trial subscriptions that might renew

- Streaming services you no longer use

- App upgrades you did not realize were active

Cancel anything that is not serving your life right now.

Avoiding lookalike sites

Some scam sites look nearly identical to real retailers.

Before you check out:

- Look for spelling errors in the web address

- Avoid ads that lead to unfamiliar domains

- Use the retailer app if you trust it

- Pay with a method that has strong fraud protection

If a deal looks wildly unrealistic, that is usually the answer.

A gentle legacy nudge

This is where tech safety meets love.

You do not need a massive project this month. Just one small step.

Choose one:

- Write down your primary accounts and where they live

- Create a simple emergency contact list

- Store passwords securely

- Decide who should have access if something happens

Legacy planning is not only about finances. It is about clarity and kindness for the people you love.

If this topic resonates, link this section to:

Small money calm for December

This is not financial advice. It is a wellness mindset that helps reduce stress.

Try this simple three part approach:

- One spending pause before any unplanned purchase

- One weekly budget glance just like the banking scan

- One realistic gift boundary that fits your life

If you want a light companion post here, you can link to your beginner investing or retirement encouragement content.

Your quick December checklist

Save this section.

Once a week

- Check banking activity

- Clean up inbox

- Ignore surprise text links

- Update one password

- Review subscriptions

Before buying gifts online

- Use trusted retailers

- Avoid urgency language

- Watch for lookalike sites

- Double check the URL

For peace of mind

- Take one small digital legacy step

My personal note

I care about this topic because health and longevity are not only about food and movement. They are also about reducing stress, protecting your household, and feeling confident in how you move through the digital world.

This checklist is meant to feel like support, not fear.

Small habits. Real protection. Calm energy.

Want more simple routines for thriving beyond 60

If you are enjoying my December content, you might also like:

- Year End Digital Checkup After 60

- AI, Media, And Misleading Quick Wins

- The Kindest Gift You Can Leave Behind

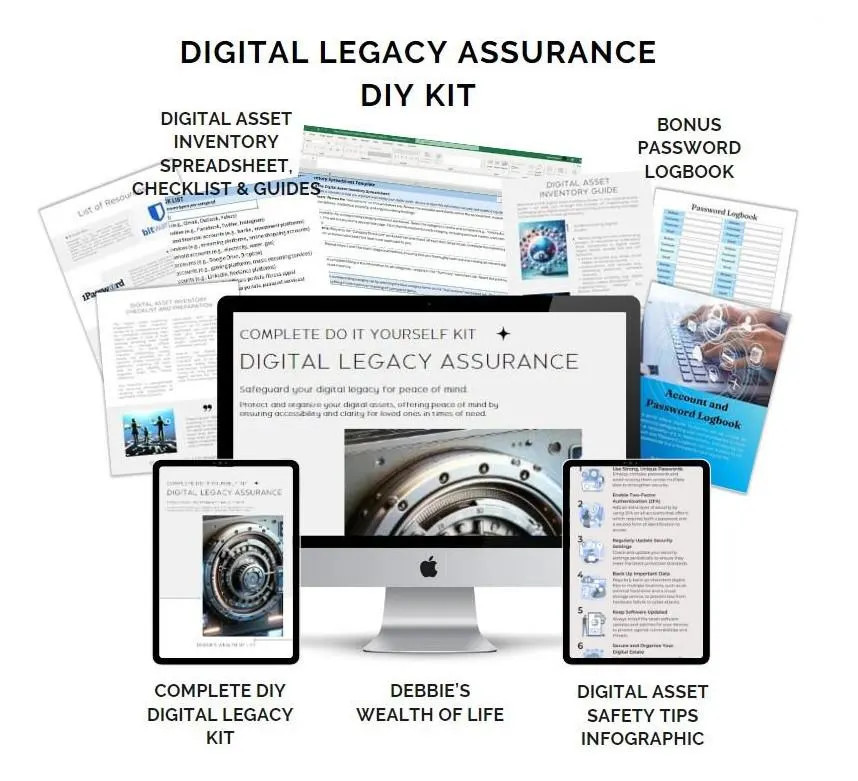

And if you want a step by step way to organize your digital life for yourself and your family, explore my Digital Legacy Assurance DIY Kit.

Disclaimer

This is for educational purposes and not financial or legal advice.

Disclaimer:

This content is for informational purposes only and is not medical advice. Always consult your healthcare provider before making changes to your diet, supplements, or lifestyle, especially if you have existing conditions or take medication.

💌Want plant-based tips each week

Join the Plant Based Flex newsletter. It’s free, and when you confirm your email I’ll send you a 7-Day Kickstart Wellness Bundle to help you thrive beyond 60.